Battery electric cars are making headlines, but fuel cells are gaining momentum – for good reason. Hydrogen can play an important role in renewable energy systems and future mobility.

At the COP21 conference in Paris in 2015, 195 countries agreed to keep global warming below the pre-industrial level of 2 degrees Celsius. To achieve this goal, even if the population grows by more than 2 billion, by 2050, the world still needs to reduce energy-related carbon dioxide (CO2) emissions by 60%. This requires dramatic changes in our energy systems: a significant increase in energy efficiency, a transition to renewable energy and low-carbon energy carriers, and an increase in the rate of carbon dioxide emissions from industrial capture, storage or reuse of surplus fossil fuels.

Two years after the Paris Agreement, at the COP23 meeting in Bonn, the Hydrogen Council (a coalition of 18 companies in the automotive, oil and gas, industrial gas and equipment industries) proposed how hydrogen contributes to ambitious climate goals. Vision. It believes that hydrogen is a catalyst for the transition to renewable energy systems and is a widely used clean energy carrier. If serious efforts are made to limit global warming to 2 degrees, the Council estimates that by 2050, hydrogen may account for about one-fifth of total emissions reductions. If policymakers, industry and investors step up their efforts to accelerate the deployment of low-carbon technologies, this vision is ambitious, but also feasible.

Hydrogen can play seven main roles in energy transformation

Hydrogen is a versatile energy carrier that can be produced with a low carbon footprint. It can play seven main roles in energy conversion, from the backbone of the energy system to the decarbonization of the end use (Figure 1):

Strengthen the renewable energy system (1-3). By providing long-term energy storage, hydrogen can enable large-scale integration of renewable power into energy systems. It allows energy to be distributed across regions and seasons and can be used as a buffer to improve the resilience of the energy system.

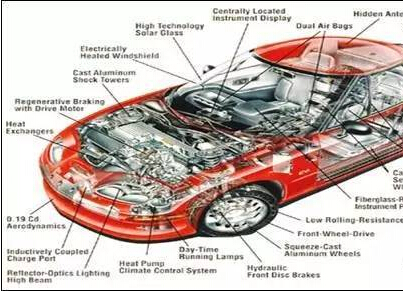

Decarbonization in the transportation sector (4). Today's transportation sector relies almost exclusively on fossil fuels, producing more than 20% of its carbon dioxide emissions. Hydrogen vehicles offer the convenience of high performance and fast refueling times, complementing battery electric vehicles and enabling extensive decarburization in the transportation sector.

Industrial energy uses side decarburization (5). In heavy industry, hydrogen can help decarburize processes that are difficult to energize, especially those that require high levels of heat. Hydrogen can also be used in cogeneration plants to produce industrial heat and electricity.

Building heat and electricity decarburization (6). In areas with existing natural gas networks, hydrogen can rely on existing infrastructure and provide a cost-effective method of heating and decarburization.

Provide clean materials (7) for the industry. At present, the amount of hydrogen used as an industrial raw material - more than 55 million tons per year - can be completely decarbonized. Hydrogen can also be used to produce cleaning chemicals and steel, as a chemical feedstock with the captured carbon and as a reducing agent for iron ore.

Figure 1 Seven roles of hydrogen energy in energy transition

The role of hydrogen in the transportation sector is reflected in the vision of the entire system.

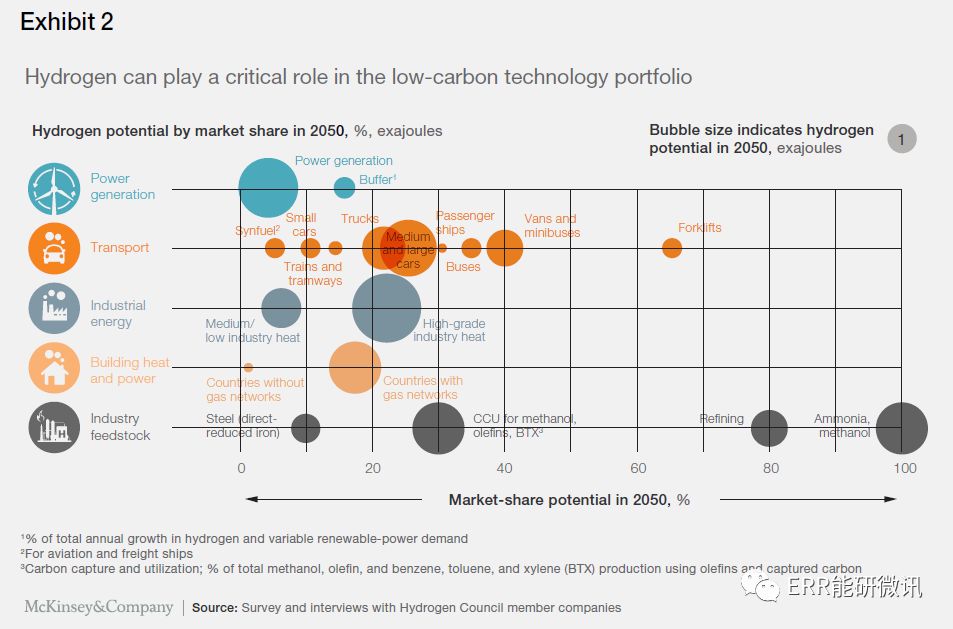

As mentioned above, hydrogen has a wide range of applications in energy systems (Figure 2), the most important of which is the decarbonization of the hydrogen transport sector. In the vision of the Hydrogen Energy Commission, hydrogen is heavily deployed to limit global warming to 2 degrees, and one-third of global hydrogen demand growth may come from the transportation sector. By 2050, members of the committee believe that hydrogen-powered fuel cell vehicles can account for 20% of the total number of vehicles, about 400 million vehicles, 15 million to 20 million trucks and about 5 million buses. In their vision, hydrogen will play a greater role in heavier and remote sections, so because of the longer distance traveled by these sections, fuel efficiency is lower, and hydrogen contributes to the total emission reduction targets of the road transport sector. About 30% higher than its share.

Figure 2 Hydrogen can play a key role in the low carbon technology portfolio

In the committee's vision, hydrogen-powered locomotives can also replace 20% of diesel locomotives, which can power aircraft and cargo ships. In summary, if hydrogen is deployed to the extent described, the transportation sector can reduce 20 million barrels of oil per day.

Fuel cells can replenish batteries to decarbonize transportation

Hydrogen and batteries are often described as competing technologies, and in recent years batteries have received a lot of attention ("proton-to-electrons"). However, the relative strengths and weaknesses of these technologies suggest that they should complement each other. Battery electric vehicles have higher overall fuel efficiency, as long as they are not overweight due to oversized batteries, making them ideal for short-range and light-duty vehicles. Hydrogen can store more energy at a lighter weight, making the fuel cell suitable for vehicles with heavy loads and long distances. Faster refueling also benefits commercial fleets and other vehicles that are almost continuously used. How technology is relevant will depend primarily on how battery technology will evolve and how it can be achieved by scaling fuel cell production.

By 2030, about 80 million zero-emission vehicles will be needed on the road, and by 2050, the average carbon dioxide emissions per person per kilometer will be reduced by 70%. Achieving these ambitious goals will require a range of power systems and fuels.

Not only battery electric vehicles (BEVs) and fuel cell electric vehicles (FCEVs) will not compete, and the increasing success of BEVs may actually drive the adoption of FCEVs. Both technologies benefit from the widespread acceptance of electric vehicles, and the ever-increasing scale reduces the cost of electric drivetrains and other components. Industry experts believe that the total cost of ownership of BEVs and FCEVs may converge in the next decade and be competitive with internal combustion engine (ICE) vehicles for 12 or 15 years from today.

Based on their entire life cycle, FCEVs achieve very low CO2 emissions, in part because they do not require large energy and resource-intensive batteries. Even though FCEVs use hydrogen from natural gas without carbon capture, they are 20 to 30% less carbon dioxide emitted by internal combustion engine driven vehicles. In fact, hydrogen has a lower CO2 intensity: many gas stations extract hydrogen from electrolysis through renewable electricity, and fossil energy production can be combined with efficient carbon capture and storage.

Priority segmentation and use cases can lead the way of transportation

As with other industries that have changed technology, the adoption of hydrogen may fluctuate (Figure 3).

Figure 3 Hydrogen can be started from passenger cars and buses

The commercialization of hydrogen fuel vehicles has begun to be applied to passenger cars because hydrogen fuel vehicles are best suited for larger market segments. In Japan, South Korea, the United States (especially in California) and Germany, three FCEVs (Honda Clarity, Hyundai ix35/Tucson Fuel Cell and Toyota Mirai) are commercially available, and another 10 are expected to be released by 2020. Ride-on or taxi services that require long uptime may drive early adoption, while ambitious national targets—such as the 1.8 million FCEVs on China and Japan on roads in 2030—may generate additional momentum.

Due to concerns about local pollution, hydrogen buses have begun to receive attention, especially in Europe, China, Japan and South Korea. South Korea plans to convert 26,000 buses into hydrogen, while Shanghai alone plans to buy and operate 3,000 fuel cell buses by 2020. Vans and minibuses can also benefit from strict supervision of urban transport vehicles and other commercial fleets.

Trucks carrying heavy payloads over long distances are another priority. Due to long distances and defined routes, they may require less infrastructure: some estimates indicate that 350 gas stations can cover the entire United States. Well-known manufacturers such as Toyota and startups such as Nikola Motors have begun manufacturing heavy and long-haul trucks to capture the opportunities of the booming freight industry.

Fuel cell trains can replace many diesel-powered locomotives in non-electrical tracks. The first fuel cell tram has been operated in China, and Alstom's first "hydraulic" train will begin to pick up passengers in Germany in early 2018.

To achieve the ambitious 2050 goals outlined in the vision, important milestones must be achieved by 2030. The Hydrogen Energy Commission estimates that one of the 12 cars sold in California, Germany, Japan and South Korea can use hydrogen if it promotes infrastructure and expands production. Worldwide, approximately 50,000 fuel cell buses and 350,000 fuel cell trucks will also be on the road, saving as much as 3.5 million hydrogen-powered passenger cars.

In order to accelerate the development momentum, industry, investors and policy makers need to increase their efforts.

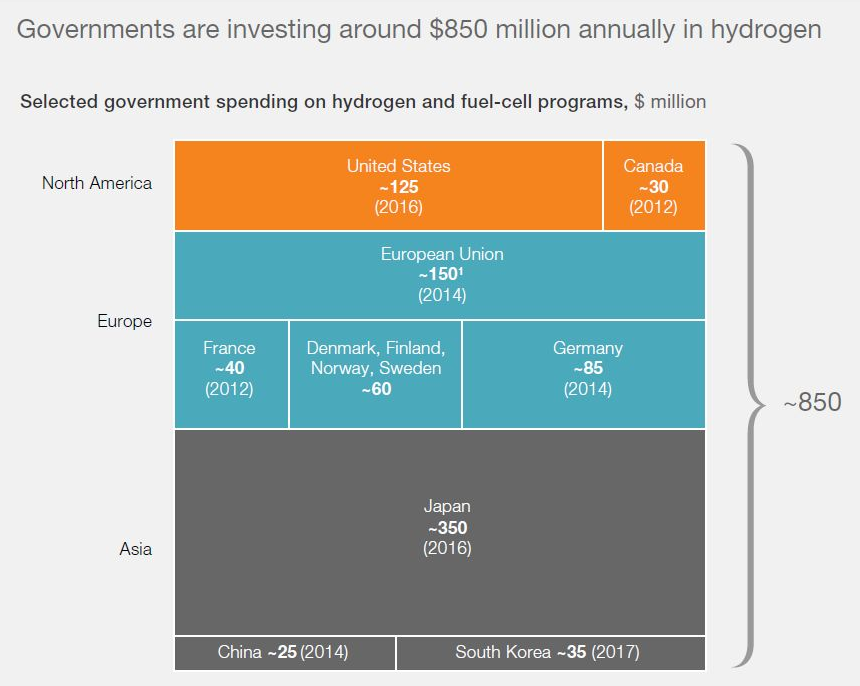

A group of regions led by California, Germany, Japan and South Korea is driving development, spending more than $850 million a year on hydrogen and fuel cell technology (Figure 4). Other countries are also actively paying attention, including China, which is beginning to expand its manufacturing capabilities and network of gas stations. On a global scale, countries have announced that they will build approximately 2,800 hydrogen refueling stations by 2025. This is a small figure compared to the estimated 600,000 gas stations around the world, but if this is done, it will be enough to cover the main market for hydrogen vehicles (G2Mobility, Germany's initiative, estimates that the country covers 400 gas stations).

Although these investments are critical, more investment is needed to reach scale and reduce costs. At present, the cost of carbon dioxide saved by fuel cell vehicles is estimated to exceed $1,500/ton, and around 2030-2035, in order to balance this technology with traditional technology, large-scale promotion is needed. Reducing costs, expanding infrastructure, and increasing model choices are prerequisites for stimulating customers to embrace the technology.

The Hydrogen Energy Commission estimates that it will require $280 billion in investment by 2030. About 60% of this investment is used to expand hydrogen production, storage and distribution, and 30% for series development, production lines and new business models. Less than 10%—about $20 billion—will require the construction of a global hydrogen refueling infrastructure of 15,000 sites, and the current lack of this infrastructure is the main bottleneck used by FCEVs.

Expanding infrastructure deployment must further reduce hydrogen costs. Building a medium-sized gas station in Germany has cost half of what it was five years ago, about $1 million, but needs to be further reduced to support access to the mass market. Depending on the size, the Hydrogen Council estimates that the infrastructure cost per FCEV may be less than $1,000. Similarly, vehicle costs need to be further reduced to support the promotion to the mass market.

Figure 4 The government invests approximately $850 million in hydrogen per year

Although the total annual investment demand is 20 billion to 25 billion US dollars by 2030, this is a major advancement for the hydrogen energy industry, but the world has invested more than 1.7 trillion US dollars of energy each year, including 650 billion US dollars. Oil and gas, $300 billion in renewable electricity, and the automotive industry exceed $300 billion. In the medium term, investment can create a self-sufficient market of more than $2.5 trillion and create about 30 million jobs in the value chain—based on current cars, equipment sales of about 12 jobs per $1 million. The multiplier of the post, and the oil and gas industry – if the vision of 2050 is achieved.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite