Influencing factors analysis

First, favorable factors

(I) Government subsidies to charge subsidies

The Circular on Adjusting the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles issued in December 2016 clearly pointed out that local governments at all levels should scientifically formulate new energy vehicle promotion programs and increase the charging infrastructure for new energy vehicles. Support efforts will be made to increase the replacement of new energy vehicles in the public service sectors such as public transportation, rental, and sanitation. The deputy director of the Energy Bureau once stated at the forum of the China Electric Vehicle Hundred People's Association that the future direction of subsidies will be tilted from the purchase of vehicle subsidies to the charging subsidies until the 2020 subsidies for new energy vehicles are completely eliminated.

(II) Development of New Energy Vehicles Drives the Demand for Charging Stations

At present, the number of new energy vehicles in China has reached 1.004 million, accounting for more than 50% of the global new energy vehicles. From January to June 2017, new energy vehicles sold 195,000 vehicles, of which pure electric vehicles accounted for 75% of sales. Electric vehicles are the main direction for the development of new energy vehicles in China in the future, and the promotion of electric vehicles will inevitably require the effective coverage of charging facilities. In addition, the government’s determination to develop a new energy automotive industry has never changed. On July 4th, 2017, at the symposium on the promotion and application of new energy vehicles hosted by Vice Premier Ma Kai, Ma Kai proposed to meet the requirements of “three overall plans” and “four innovations”, and firmly stated that he must “keep it on The national strategy for the development of new energy vehicles will not be shaken, which fully demonstrates the government's position to resolutely develop new energy vehicles. With the development of new energy vehicles, the demand for power stations will also increase.

(III) Intelligent charging technology is maturing

The rapid development of smart charging technology has greatly improved the charging efficiency of electric vehicles. Taking ABB as an example, the launch of the DC rapid charging machine Terra63Z with an output power of 60 kW and an electric vehicle with a cruising range of 250 kilometers can be filled in about 30 minutes. The need for quick charging on the road. Shortening the charging time can effectively increase the utilization rate of the charging pile and expand the service and profitability of the charging pile operation.

Second, unfavorable factors

(I) Incompatibility issues are highlighted due to imperfect industry standards

At present, in terms of charging infrastructure construction, the industry standards are not perfect, which not only results in the individual operators of the platforms themselves, the cooperation is not smooth, the used charging cards and APPs are different from each other, and the built-in charging piles have their interfaces and communication protocols and new versions. The national standards for charging infrastructure are also incompatible. This lack of versatility, openness, and inefficiency of use has greatly limited the development of charging infrastructure.

(B) The profit model is fuzzy

The initial investment in charging infrastructure construction is relatively large, and it will take a very long cycle to recover costs only through charging charges. Judging from the operating examples of power grid companies, the idle rate of charging facilities is relatively high, and the cost of construction in the early stage is relatively large. It is difficult to rely on income from simple electricity charges to recover investment in the short term. And the charging infrastructure market is in its infancy. Many companies in the industry are still exploring the ways to operate and manage the charging infrastructure.

(III) Ignoring User Experience by Playing Price War

Although the current profit model is ambiguous and there are few companies that can achieve profitability, many regional operating service providers still compete in the market competition to compete in the price competition. They only care about the number of products and sacrifice product quality. This kind of vicious competition makes the charging basis. The quality of facilities varies greatly. In addition, although there are sufficient charging infrastructures in the developed highway network in China, the user experience is poor. The price war has depressed the profit margin, making it more difficult for operators to obtain sufficient returns to continue to invest in construction.

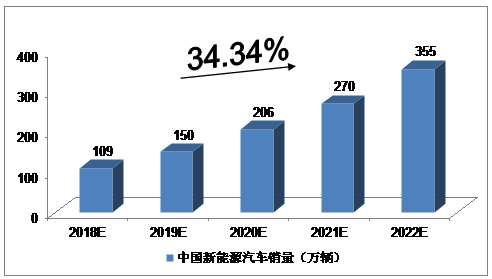

China New Energy Vehicle Sales Forecast

In 2015, the sales volume of new energy vehicles in China was 331,000, an increase of 3.4 times year-on-year. In 2016, the sales of new energy vehicles reached 507,000, an increase of 53.1% year-on-year. In 2017, sales of new energy vehicles were achieved. It was 777,000 units, an increase of 53.3% year-on-year.

We expect that in 2018 China's new energy vehicle sales will reach 1.09 million units, and the average annual compound growth rate will be about 34.34% over the next five years (2018-2022), and it will reach 3.55 million units by 2022.

Chart China Investment Advisors' Forecast for China's New Energy Vehicle Sales in 2018-2022

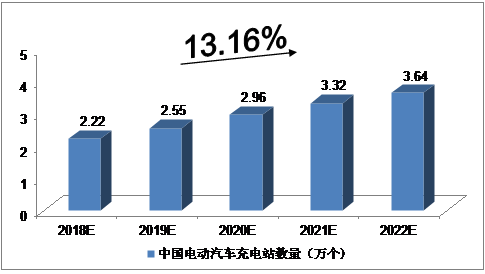

China Electric Vehicle Charging Station Forecast

As of the end of August 2017, the number of electric vehicle charging stations in China was 17,098. We estimate that the number of electric vehicle charging stations in China will reach 22,200 in 2018, and the compound annual growth rate will be approximately 13.16% in the next five years (2018-2022). The number of electric vehicle charging stations in China will reach 3 in 2022. 64,400.

Chart CDIC Advisors' Prediction of the Number of Electric Vehicle Charging Stations in China from 2018 to 2022

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite