Buffett once said that the risk of investment is that you do not know what you are doing. Lithium plate today, the power of the battery business "rocket-style" outbreak of the growth, the red behind the daily limit, the industry risks along with the line, those power battery business investors know what they are doing?

After the return of the capital of the coming of the return of the capital or to kill

According to the Eastern wealth Choice statistics, as of July 31, 2017, in the 85 lithium battery-related listed companies issued semi-annual report, the expected net profit of more than 500 million yuan 7; more than 100 million yuan of 39 , Accounting for 45.88%; expected net profit is negative, only five. Power battery industry seems to be booming, but in fact the day is not as we imagine the "scenery".

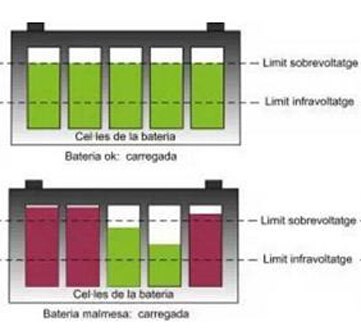

With the national new energy vehicle policy subsidies to recile, "30,000 km" and other more stringent subsidies introduced, the new energy vehicles have been the era of subsidies, in turn usher in more stringent national policy, production standards more clearly, corporate subsidies Gradually diminished "post-subsidy" era.

Government subsidies to reduce the cycle of the vehicle business longer, longer cost of battery materials, more stringent technical requirements, production line adjustment and changes in power battery companies have to spend huge sums of money and great care. To solve the dilemma of capital card neck, choose to embrace the capital to become the majority of power battery business initiative or passive choice.

However, in the era of subsidies, too many investors blindly optimistic about the new energy vehicles this piece of cake, that the new national energy vehicles will benefit the policy of the upstream enterprises, in order to seize the investment outlet, not ready to enter the power battery industry gold rush. I do not know the policy direction of a change, power battery companies need funds, technology, production equipment are beyond the original expectations. They face the future of the more severe situation, can only think of ways to stop the capital from the power battery industry to withdraw from the era of subsidies after the "return to Come".

Mr. Qian Zhongshu in the "Besieged City" in the elaboration of the siege of marriage Some people want to come in, some people want to go out, and this reason to get today's power battery industry also applies. In addition to "return to Come", there are a number of "kill themselves" to send. Power battery relative to other already facing the "ceiling" of the industry, as the outlet shows the investment potential is very attractive. Has always been to maximize the interests of the pursuit of capital, the "unsuccessful, it will become benevolent", the power battery industry to become the most profitable growth point.

The new energy automotive industry from the import into a mature transition period, will also be the key to the adjustment of power battery companies critical period. For investors, there may be any advance and retreat, but the enterprise is only the survival of the election, in the face of harsh market choices, how to retain the "return to Come", to meet the "kill the body" to become a business based on the key The

Integration intensifies competition to power the battery industry capital king

"New Testament Matthew" said: Where some, but also double to him to call him redundant; no, even his all have to take over. And now this sentence is profoundly reflected in the power battery industry. After the subsidy era of competition, integration has become the post-subsidy era power battery industry's main theme, with a small number of enterprises occupy the market pattern, the emergence of power battery industry giants, power battery market, "enclosure movement" will be more intense. With the "enclosure" of the occurrence of power battery mergers and acquisitions between enterprises will also be more frequent, and these mergers and acquisitions activities can be divided into the following three categories:

Large enterprises in order to improve the industrial layout or in order to strengthen the competitiveness of the annexation of small businesses. Such as: South Power to spend 1.96 billion yuan to buy 49% stake in platinum technology, the battery recycling industry chain layout; billion Wei Li can not be higher than 150 million acquisition of Wuhan Fu Ante all the shares.

Giants enterprises, capital group strong combination, to strengthen the competitiveness of enterprises competing. Such as: CIMC Group affiliated enterprises, Dalian Wanda and Dong Mingzhu and other five enterprises and individuals and Yinlong new energy co-capital increase of 3 billion yuan, 22.38% stake in Yinlong new energy.

Capital Group cross-industry acquisition of lithium enterprises, increase the growth of industrial profits. Such as: Group Hing toys to be 2.9 billion acquisition of space-time energy 100% stake; Youfu shares to be 10.09 billion acquisition of 51% stake in Jiangsu Chi Hang, from the traditional textile industry into the power battery industry.

With the intensification of market competition, more business pressure will be transferred to the capital chain. Such as the ugly fish-like power battery companies desire for capital injection, mergers and acquisitions between enterprises will be more frequent. But in the industry situation gradually clear the case, capital investment will be more targeted, to meet the capital group "mate" standard power battery companies will be less and less. For most power battery companies, it will be more difficult to get capital financing support. The power of the battery industry, "Matthew effect" will be further apparent, and in this effect, those who have the potential investment power battery companies have to face the assessment of assets, equity dilution or increase the pressure on the share of gambling. The kingdom of capital is coming.

Is the Bole or Cao Cao power battery companies need their own face

It is estimated that in 2017 China's demand for power batteries will increase to 31Gwh, and by 2020 the demand for power batteries will reach 125Gwh. At present, domestic power battery enterprises with higher annual production capacity, but the actual output is not high, especially to meet the new energy vehicles, high-end power battery is still tight. There is no doubt that the big battery will continue to attract more capital injections.

But it is worth noting that any one of the mergers and acquisitions behind the enterprise has a very complex interests of disputes. Capital injection in addition to bring more vitality for the enterprise, but also will bring a series of problems. Capital is to explore the Maxima's Bole, or "rather I can not bear the world, not the world people I" Cao Cao, for the power battery business, but also to see separately. There is no free lunch in the world, capital joint venture "honeymoon period" in the Qingqing me, but in the pursuit of their own interests to maximize the road on the inevitable choice, and power battery companies can produce a satisfactory answer, is the " Day "can go on the key.

Last week, long-term science and technology dream Bok power, 6.75 billion acquisition program due to policy reasons and had to come to an end. Despite the suspension of the acquisition, long letter technology is still self-financing to buy the way to buy Biker power of not more than 20% of the shares, and said that once the policy allows to continue to restart the acquisition plan. In the sigh long letter technology on the Bike power "love deep", long letter technology so persistent power battery industry can not help but think. I believe that in addition to fancy power battery industry's high growth, the BAK power to make the 2017-2019 three-year net profit will be not less than 700 million, 1.2 billion and 1.25 billion pairs of gambling agreement is also long letter technology One of the reasons. For the time being to talk about bikes of the gambling agreement is too high, for the "killer" faction, similar to Bicker battery such a good standard will be less and less in the future, and "Maxima" missed, May never lose the ride to take the lithium to let the capital of high-speed growth of the train.

But the gold Wright has staged a "trouble is not good" bitter drama. Seize the bitter bitter gold and the withdrawal of Zhejiang Province, Zhejiang is the capital of the capital after the face of the ruthless. Zhejiang installation of the main lithium battery research and development and sales, of which 15.5 million yuan investment in gold Wright, holding 51%. However, due to the failure of Zhejiang lithium battery to master the core technology, the lack of core management team, in the lithium market competition in the fierce competition again and again, the final gold Wright termination of the investment in Zhejiang, became "white face" Cao Cao. And as investors of the gold Wright also by the negative effect of Zhejiang anti-bite, corporate profits were cliff down, 2016 net profit fell 83.83% year on year, suffered a blind investment "bitter fruit."

The so-called competition, the survival of the fittest. Whether it is capital of investors, or in the front line of power battery business, when they want to get involved in the lithium industry to obtain high returns, but also to understand their own to bear the high risk. With the capital inflows such as Dalian Wanda, Zhuhai Dong, Qunxing Toys, Southern Black Sesame Paste and other capital inflows, "people outside the city" will play a "lithium battery" with their own thoughts.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite